Distillers of American whiskey and bourbon were close to drowning in their own whiskey river.

Instead, they avoided a torrent of tariffs.

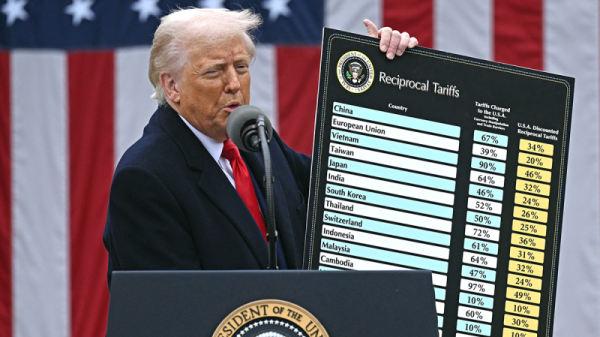

The European Union was slated to slap a staggering 50 percent tariff on distilled spirits produced in the U.S. as of Jan. 1. But an emergency truce brokered by U.S. and European trade negotiators blocked what could have been a substantial upcharge to sell American distilled spirits to the EU.

‘Bourbon has actually been growing all over the world,’ said Senate Minority Leader Mitch McConnell, R-Ky., in an interview. ‘It used to be sort of a Southern, United States preference. But the whole industry has really picked up over the last five to 10 years. And Europe is a good market for us.’

McConnell and bipartisan senators wrote several weeks ago to U.S. Trade Representative Katherine Tai, urging a solution before the tariff increase hit.

‘It’s a devastating potential impact on us,’ warned McConnell. ‘Bourbon is a big deal in Kentucky. It employs thousands of people. If this tariff goes into effect, it will cost a lot of Kentucky jobs, both in the bourbon business and, for example, corn growers who supply corn to the bourbon.’

Sen. Rand Paul, R-Ky., also signed the letter sent to Tai.

‘I’m from Kentucky. I have to be concerned about bourbon. We don’t want our bourbon to be tariffed. And so this is a lingering effect of the trade war,’ said Paul. ‘It’s a multibillion-dollar industry now.’

Sen. Tim Kaine, D-Va., was stunned to learn how much whiskey Catoctin Creek, a Virginia distillery about an hour outside of Washington, D.C., sells to the EU.

‘They said, ‘These tariffs are killing us.’ I said, ‘Wait a minute, I thought you guys sold whiskey right here.’ And they said, ‘Yeah. But about 40% of our product at that point is for export because people really like American whiskey. They like Virginia whiskey,’’ said Kaine.

Consider for a moment the impact of tariffs.

U.S. bourbon staples like Jim Beam or Blanton’s are prominent in Europe. They come from big distillers in Kentucky (Buffalo Trace distills Blanton’s). But tariffs could inhibit boutique distillers from selling their whiskeys abroad. It may be hard to find something overseas like Brother Justus from the Twin Cities, Kings County from New York, or Northside from Cincinnati.

One distillery that actively sells to the EU is Boulder Spirits in Boulder, Colorado. Alastair Brogan is the owner and master distiller. Originally from Glasgow, Scotland, Brogan has marketed his expressions to Europe.

‘We’re actually selling our single malt whiskey Boulder American into Scotland itself,’ said Brogan. ‘American whiskeys have got a real foothold into Europe. Europeans are beginning to realize that there is more to whiskey than just Scotch.’

Of course, Scotland is part of the U.K. And post-Brexit, the U.K. is no longer in the European Union. But Brogan echoed Kaine about Europeans discovering sweeter, woodier, vanilla expressions from the U.S. rather than malts produced in Scotland, Northern Ireland or the Republic of Ireland.

But added tariffs would be a killer.

‘We built a market,’ said Brogan. ‘But we can’t sustain 50 percent tariffs. So we would have to come out of the European market.’

The tariff threat forced Brogan to tell his European distributor he wouldn’t reserve space for an upcoming shipment.

‘We’re focusing in other markets,’ conceded Brogan. ‘So yeah. A few sleepless nights.’

From a taste standpoint, Americans are used to enjoying smoky, peaty malts from Scotland’s ‘whisky isle’ of Islay like Lagavulin and Caol Ila. The same with sweeter spirts from the Speyside region like Glenfiddich or Macallan. But it’s a treat when they stumble upon more obscure Scottish malts like Tormore, Bladnoch or Dailuaine. Those labels are hard to find in the U.S. But when Americans do, it’s a palette-altering experience. And for the same reason, Europeans are discovering they enjoy more obscure offerings, say from Boulder Spirits or Catoctin Creek.

However, none of that happens without open trade. Massive tariffs tramp on that.

Ken Troske is an economist who studies trade at the University of Kentucky.

‘I have plenty of bourbon myself,’ said Troske. ‘I have whiskey from Tasmania, which is some of the best made in the world. And I had to go to Tasmania to purchase it. I’d love to get some in the United States.’

Hence, the consumer impacts of tariffs — to say nothing of connoisseur blight — when it could be blithe.

‘Political leaders in recent years have just gotten, for lack of a better word, stupid about the benefits of trade,’ said Troske. ‘How they would get hung up on something as small as moving distilled spirits around the world escapes me. Why? Why? That’s an easy fix.’

The current ‘fix’ is but an interim one. It blocks the whiskey and bourbon tariffs until after the inauguration of the next American president in January 2025. But distillers remind negotiators that they’re dealing with spirits that require aging. Straight bourbon is aged only two years. Most bourbons are aged three years or longer. Sometimes seven or eight years. Thus, any unpredictability makes it hard for distillers to gauge how much product they should make now — especially when the surcharge to Europe could hit in 2025.

A crystal ball would help. But forecasting the distilled spirits market years in advance is nearly impossible. At least established tariffs would eliminate one variable.

‘What we’re really looking for is permanency,’ said Brogan. ‘And having that, you (can) trade within the European Union and the U.S.’

So, it may be a disappointment for Europeans just getting a taste for rare, exotic American whiskeys. But there could be an upside for American consumers. Withholding U.S. spirits from Europe could create a glut here at home.

‘That might result in a decline in price in the U.S.,’ observed Troske.

That could form a whiskey river here in the U.S. But certainly not a river of cash for American producers.