The US Securities and Exchange Commission (SEC) has reopened its investigation into Neuralink, Elon Musk’s brain-implant company, alongside a probe into Musk’s acquisition of Twitter, now rebranded as X.

A letter from Musk’s lawyer, Alex Spiro, disclosed the development on Thursday (December 12), raising questions about the ongoing legal disputes between Musk and the SEC, according to a Reuters report.

The letter, addressed to outgoing SEC Chair Gary Gensler, outlines the reopening of the Neuralink investigation and a settlement demand regarding the Twitter takeover, which happened in 2022.

The SEC has reportedly issued Musk a 48 hour deadline to accept a settlement offer or face enforcement action.

Details about the settlement amount have not been disclosed, and the SEC has yet to comment on the matter, citing its confidentiality policy regarding investigations.

Musk’s contentious history with the SEC

The SEC’s investigation into Neuralink adds another layer to Musk’s longstanding conflicts with the agency.

While the exact nature of the Neuralink probe remains unclear, Musk’s acquisition of Twitter over two years ago has been under scrutiny due to the timing and disclosure of his stock purchases.

Musk began acquiring Twitter shares in early 2022, eventually reaching a 9 percent stake before announcing plans to buy the social media platform outright for US$44 billion.

The letter accuses the SEC of harassment, referencing prior legal battles between Musk and the commission.

In 2018, Musk faced a lawsuit from the SEC over a tweet claiming he had secured funding to take Tesla private.

That case was resolved with a US$20 million fine; Musk also had to step down as Tesla’s chairman, and Tesla lawyers were required to review some of his public statements.

In his letter to the SEC, Spiro criticizes the government body’s actions, questioning the motivation behind the investigations and alleging that they were politically influenced. The lawyer also demands transparency about whether Gensler or other government entities have been directing what Spiro calls a campaign against Musk.

Neuralink, which was founded by Musk in 2016, aims to develop brain-computer interfaces with potential applications in medical treatment and human enhancement.

The company has faced challenges, including public and legal scrutiny over its research practices.

In 2023, the Physicians Committee for Responsible Medicine and four US lawmakers urged the SEC to investigate Neuralink for possible securities fraud, alleging that the company made misleading claims about its technology.

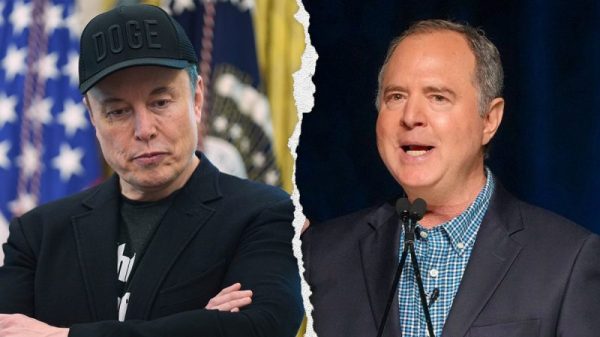

Musk has frequently expressed disdain for the SEC in the past. Following the publication of Spiro’s letter, he posted an image mocking Gensler on X, accompanied by a dismissive caption.

Deepening relationship between Musk and Trump

The investigation comes at a crucial time for Musk as his influence expands.

He is a member of a task force established by President-elect Donald Trump to oversee government reforms, and spent significant resources supporting Trump’s political campaign.

In November, a federal judge denied an SEC request to impose sanctions on Musk for failing to comply with court-ordered testimony related to the Twitter acquisition probe. Currently the outcome of the reopened Neuralink investigation and the ongoing Twitter acquisition probe remains uncertain.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.