Baltimore business owners are bracing for a difficult spring as authorities clear the collapsed Francis Scott Key Bridge, but many are hopeful the worst disruptions will be short-lived.

Alex Del Sordo bought the Hard Yacht Cafe, a more than 30-year-old waterfront restaurant with its own small marina, just 10 days before the Dali, a Singaporean cargo ship, smashed into the bridge on March 26, killing two workers and leaving four others presumed dead.

“We don’t want to fire anybody,” Del Sordo said of his 75 employees Friday. “We want to keep them here — working, happy, healthy.”

Del Sordo has offered first responders 50% off at the cafe over the past week, which has dented his bottom line. His biggest concerns now are “stabilizing costs for our employment and keeping the lights on,” he said.

Baltimore is not closed just because the bridge is closed.

Colin Tarbert, president and CEO of the Baltimore Development Corporation

The restaurant’s marina, usually booked with pleasure boaters, can’t relocate them to accommodate those involved in the bridge response, he added. “We don’t know what to do with all the boats out here on our property. We don’t know where they’re going, how they’re gonna get out of here.”

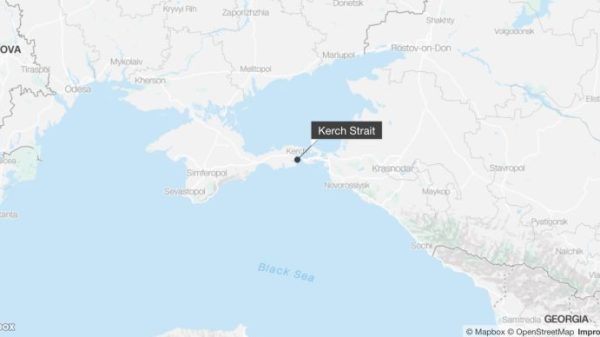

The Hard Yacht is perched on Bear Creek, a waterway feeding into the Patapsco River, which the Francis Scott Key Bridge had spanned for decades. It’s among the businesses in Baltimore’s historic Dundalk neighborhood that are taking a hit from port disruptions while the cleanup continues. Vessel traffic is currently suspended both into and out of the Port of Baltimore, a spokesperson said, though trucks are still being processed out of the marine terminals.

The Army Corps of Engineers plans to open a 35-foot-deep limited access channel near the wreckage to accommodate barges and smaller commercial ships by the end of this month. A deeper 50-foot channel that allows container ships to pass through is expected to reopen by the end of May. Currently, just two channels less than 15 feet deep are open to vessel traffic, which remains minimal.

Some area businesses liken the fallout to the early days of the pandemic, but many say the upheavals of the last few years have prepared them for a crisis of this magnitude. Even so, key parts of the city’s and region’s economy, from trucking to commercial real estate and local restaurants, rely on the port, which handled a record $80 billion worth of foreign cargo last year.

Michael Clark, president of BTR Logistics, which stores and dispatches cargo through the port, said the lost shipments are “going to impact probably 75% of our revenues in the short term.” Some vessels whose cargo his warehouse would otherwise accept after arriving in Baltimore are being held internationally for now.

“We’re doing everything we can right now to cut costs and stay alive,” Clark said.

Colin Tarbert, president and CEO of the Baltimore Development Corporation, an economic development nonprofit, noted that an estimated 20,000 local jobs are tied directly to the port. A top concern for surrounding businesses is how long it will take for port operations to resume at full capacity, he said.

“The longer the channel is closed, the more exacerbated the issue is,” Tarbert said. While rebuilding the bridge is expected to take years, he voiced confidence that trucks can take existing routes through the city without much business impact. That may be inconvenient, he conceded, but “Baltimore is not closed just because the bridge is closed.”

It’s going to be a slow two months, but … the heavy demand for industrial real estate is still there.

Jim Chivers, senior vice president at Gold and Company

The U.S. Small Business Administration is rolling out low-interest loans to help local employers survive the next couple of weeks. And on Friday, Maryland Gov. Wes Moore signed an executive order providing $60 million in relief funding to businesses and workers affected by the bridge collapse. The aid comes on the heels of $60 million that the U.S. Department of Transportation announced last week to support the rebuilding.

Touring the ongoing response effort in Baltimore on Friday, President Joe Biden reiterated his administration’s support for the recovery process. “This is gonna take time,” he said, but he vowed that state and federal authorities would work together to “rebuild this bridge as rapidly as possible.”

In the meantime, Clark said BTR is trying to reroute its incoming cargo shipments, primarily of plywood and steel, to other ports on the East Coast, but getting interstate trucking permits is expensive and time-consuming. The company has applied for an SBA loan but has already had to lay off around a dozen workers.

“Quite frankly, a lot of our customers have made alternative arrangements with different warehouses in different cities,” he said, “and that stuff may never come back through here until we fix this problem.”

The city’s commercial real estate sector doesn’t expect lasting fallout, said Jim Chivers, senior vice president at Gold and Company, a firm serving the Baltimore metro area. “Everyone feels that this is a short-term issue more than a long-term issue,” he said.

Even if some clients retreat, Chivers anticipates plenty of interest in filling vacated properties. “It’s going to be a slow two months, but long-term values I think will continue to remain where they are,” he said. “The heavy demand for industrial real estate is still there in Baltimore.”