The Federal Trade Commission ended its bid to block drugmaker Amgen’s $28 billion deal to acquire Horizon Therapeutics, reaching a settlement that the agency said would prevent “potential competitive harm.”

A proposed consent order prohibits Amgen from leveraging its large drug portfolio to secure preferential terms from insurers for two drugs it is acquiring from Horizon, and from trying to muscle out competitors to those drugs. It would also prevent Amgen from acquiring certain products before receiving approval from the commission, FTC said.

Amgen, based in California, said in a statement that it had agreed to a “narrow assurance” that “will have no impact on Amgen’s business.”

FTC filed suit in May to block the merger, which was the biggest proposed biotech deal in 2022, predicting it would lessen competition for drugs that treat two rare diseases. It was the antitrust agency’s first challenge to a pharmaceutical merger in more than a decade, signaling the Biden administration’s more aggressive approach as it seeks to combat high prescription drug prices. Ending the challenge could be a sign that other pending pharmaceutical mergers will face less antitrust risk, according to Wall Street analysts.

“The settlement materially mitigates regulatory headwinds” for Pfizer’s proposed $43 billion takeover of cancer-drug company Seagen, Matt Phipps, an analyst at William Blair, wrote in a research note Friday.

FTC’s attempt to block the Amgen-Horizon deal surprised some analysts, as the two companies don’t directly compete.

“Stop the insanity,” Jay Olson, an analyst at Oppenheimer, wrote in a note to clients last week after the FTC indicated it would explore a settlement. He previously described FTC’s allegations as “ludicrous.”

Douglas Farrar, an FTC spokesperson, said in an email that “defendants don’t settle ‘ludicrous’ lawsuits, and the FTC got extensive, binding agreements on all the concerns we raised in our complaint,” calling the settlement a win for “Americans who need access to affordable medicine.”

Amgen said in a statement, “As we told the Commission before they sued us, we had no reason, ability or intention to bundle” Horizon’s two prized drugs. “That’s what we agreed to. Making that agreement now instead of waiting to win at trial brings badly needed medicines to patients sooner.”

The FTC’s concerns centered on two drugs made by Horizon, Tepezza and Krystexxa, which treat thyroid eye disease and gout, respectively. The commission alleged that Amgen, with its larger portfolio of drugs, had both the clout and the motivation to protect the “monopoly positions” of those two Horizon drugs. Amgen denied it had any intention of bundling the Horizon drugs with its own in negotiations with insurers and pharmacy-benefit managers.

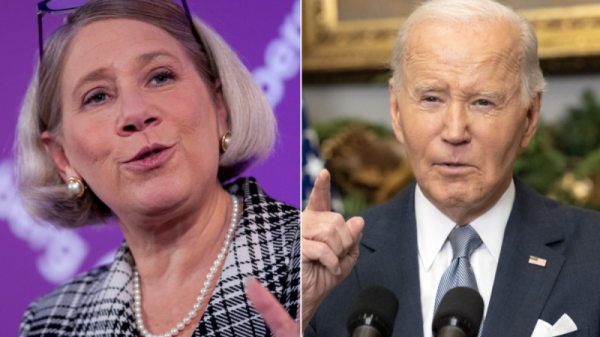

In a five-page statement, FTC Chair Lina Khan defended the commission’s scrutiny of the merger. “While the companies do not have drugs that directly compete with one another,” she wrote, the FTC evaluated “how the acquisition would change the combined firm’s power and incentive to thwart competition.”

As part of the settlement, attorneys general from six states will also drop related litigation.

Horizon shares closed up 2.3 percent Friday, while Amgen’s shares were up less than one percent. The companies expect to close the merger before the end of the year.