House Oversight Chair James Comer said the Biden family will be served with ‘two dozen’ subpoenas in the coming days related to the family’s overseas business dealings.

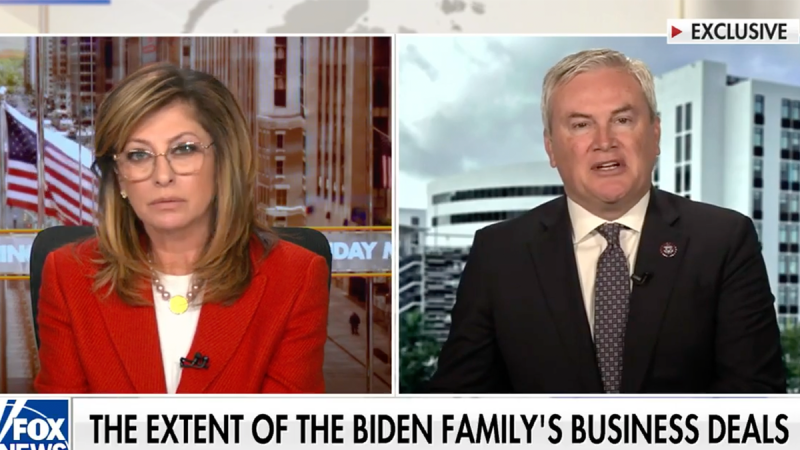

‘I think you’re gonna see swift action on Biden and I would predict somewhere around two dozen subpoenas in the very near future,’ Comer, R-Ky., told Fox News’ Maria Bartiromo on ‘Sunday Morning Futures.’

Comer is leading the House investigation into Hunter Biden’s foreign business entanglements and looking to determine what role President Biden may have played in any dealings. Republicans allege the president has financially benefited from business deals made by his family members with foreign nations.

Last week, Comer said that in 2017, President Biden received $40,000 in ‘laundered China money’ from the bank account of his brother and his sister-in-law in the form of a personal check.

Biden has repeatedly denied any involvement with his son’s business dealings.

‘We’ve always planned on doing that,’ Comer told Bartiromo when asked if the Kentucky Republican plans on questioning Hunter and Joe Biden and ‘getting subpoenas out.’

‘This has been a painful process, Maria. We’ve been obstructed. We’ve been followed at every turn, not just by the Bidens’ big money attorneys, but also by the federal government. The IRS is obstructed. The DOJ is obstructed. The Treasury has obstructed. FBI has obstructed, and the Democrats on the House Oversight Committee have pretty much been the Biden legal defense team,’ he said.

Comer said the other House oversight members can ‘connect the dots’ on a series of financial transactions between the president and his family members that he said amount to ‘money laundering.’

‘This was very organized. And the reason they did these complicated transactions, was to disguise the source of the revenue and to deceive the IRS from paying taxes,’ he said.

Comer argued that in the coming weeks, the Biden family will claim the funds were loans ‘because you don’t have to report loans on your taxes.’

‘If you’re the IRS and you’re just looking at someone’s taxes, you would never know that Joe Biden got two checks for loan repayments – $200,000 and $40,000,’ Comer said.

‘You wouldn’t know about all the money that we’re going to show that James Biden took in and Hunter Biden took in from loans. It’s an integral part of money laundering, where you deceive from the IRS about the revenue you’re taking. In other words, you’re a tax cheat.’

Fox News Digital has reached out to the White House for comment.