The core of Kamala Harris’s housing platform is a simple idea: America needs more houses. But the vice president’s pitch — to help build 3 million homes and incentivize local governments and builders to join in — stands apart from how major political candidates typically talk about housing, if they do at all.

To housing experts, the Democratic nominee’s approach has inched closer and closer to what’s known as “YIMBYism.” The slogan stands for “Yes In My Backyard,” as a rebuttal to what’s known as NIMBYism, for “Not In My Backyard.” It generally encompasses people who support boosting the number of homes available and putting them in more places. Think apartment buildings alongside single-family houses, and more public transportation to support denser neighborhoods.

Harris doesn’t use the acronym to describe herself. And there are plenty of YIMBYs who take a different approach, such as trying to withhold state or federal funding from localities that don’t take part in efforts to build more. But Harris’s emphasis on tackling America’s housing problems with more supply is a new approach for Democrats focused on voters’ concerns around affordability and a telltale part of the American Dream. Speaking on the popular “Call Her Daddy” podcast, which is aimed at young women, Harris this week said “housing is too expensive, and we need to increase the housing supply.”

“To seem compelling in a political year, you can’t do a bunch of small stuff people can’t remember. You have to go big,” said Jim Parrott, a housing adviser under the Obama administration who also advises the Harris campaign. “If she is a YIMBY, it’s a warm, fuzzy, carrot kind. Not a stick YIMBY.”

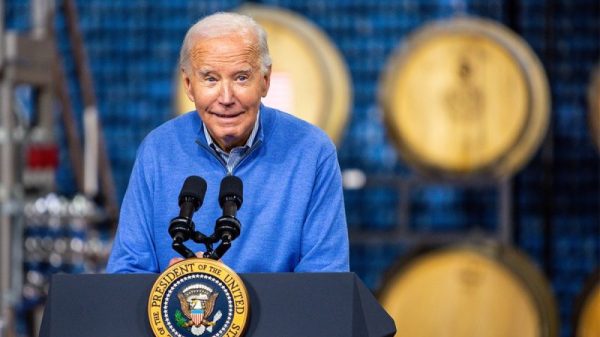

Democrats began focusing on housing policy last year, realizing the headwinds of running to keep the White House and Senate in a country overwhelmed by rising costs. President Joe Biden began addressing the problem in March with his State of the Union address, during which he announced a plan to build and preserve more than 2 million homes, along with moves to use antitrust law against corporate landlords who were indirectly coordinating in rental pricing and eliminate title insurance fees. He went further in July, in the wake of his campaign-ending debate performance, rolling out a plan to cap rent increases and make more public land available for housing before he dropped his reelection bid.

Democratic pollsters encouraged the moves, with the Navigator Research poll, an independent survey read by policymakers, presenting attacks on “greedy landlords” as an easy win, particularly among younger voters who Democrats have struggled to keep in the fold. An April 2024 Gallup poll also found the “cost of owning/renting a home” to be the second most important financial problem for families, next to the more generic “high cost of living/inflation.”

When Harris took over the ticket in late July, she immediately shifted her public rhetoric — and the campaign’s paid advertising — to focus more on combating high costs. She made her efforts to take on housing costs in California as a centerpiece of her biography, and talked about her mother saving up to buy her family’s first house.

“Right now, a serious housing shortage is part of what is driving up cost,” Harris said at a Las Vegas campaign event last month. “So we will cut the red tape and work with the private sector to build 3 million new homes, and provide first-time home buyers with $25,000 down-payment assistance so you can just get your foot in the door. You’ll do the rest.”

Harris’s plans also include expanding the low-income housing tax credit — a key program for constructing and rehabilitating rental housing for low-income households — and creating a $40 billion “innovation fund” to help local governments build more affordable housing. She has also talked about taking on corporate landlords and capping rent increases.

All of these proposals would require approval by Congress and might be difficult to push through under a divided government. And even if regulations are enacted, some economists have worried that the turbocharged buyer credits would juice demand even more, and ultimately push prices higher by giving purchasers more money to spend.

Home and rent prices took off on the heels of the pandemic, when people suddenly clamored for the few options available. In the for-sale market, mortgage rates shot up in 2022 and 2023 as the Federal Reserve raised borrowing costs to tackle inflation, leaving many first-timers shut out. (The 30-year fixed-rate mortgage peaked at nearly 8 percent last year, and has since fallen to near 6 percent as the Fed lowers rates.)

Donald Trump’s campaign has taken a vastly different approach to housing issues. During last week’s vice-presidential debate, Sen. JD Vance (R-Ohio) blamed soaring housing costs on a spike in immigration over the past few years, saying “kicking out illegal immigrants who are competing for those homes” would help affordability. In a statement, RNC spokesperson Taylor Rogers said Trump would secure the border, “ban mortgages for illegal immigrants who drive up the price of housing, and eliminate federal regulations driving up housing costs.”

“When President Trump is back in the White House, he will cut the cost of new homes in half, open portions of federal land with ultralow taxes and regulations for large-scale housing construction and end the housing affordability crisis that Kamala Harris created,” Rogers said.

The campaign’s claims that mass deportations would open housing supply has been widely debunked by economists, who argue that recent immigrants — many of whom rent and work in low-wage jobs — live in a very segmented part of the housing market. Experts and builders also caution that strict immigration restrictions would deal a serious blow to the construction industry, which relies on foreign-born labor and is crucial to home building.

No federal policy proposals can address all aspects of the housing market; state and local zoning laws have major influence over what houses can be built and where. And some proponents of YIMBYism note that there is a wide spectrum of progressive housing policies, and Harris’s plans don’t cover it all.

“I do appreciate their spin on all of this, but I think when you dig into Harris’s actual policy proposals, they are not a push for unbridled market rate supply by any means,” said Shamus Roller, executive director of the National Housing Law Project. He added that he would also like to see Harris focus more on the poorest people who are just getting by, including seniors and people on fixed incomes, who face some of the steepest affordability challenges.

Ahead of Harris’s visit to Nevada last month, several hundred advocates with the Center for Popular Democracy Action and its affiliated groups marched in Las Vegas to draw attention to the housing situation in that battleground state. They have also hosted rallies in New York, Pennsylvania and elsewhere over the past few weeks to call for more funding for affordable housing and stronger tenant protections.

While the groups are backing Harris, organizers say she still needs to focus more on issues facing renters, many of whom are young and people of color — key parts of the coalition that helped Biden win in 2020. Some of Harris’s proposals — like $25,000 first-time buyer credit — are “great for people that are in a situation to be buying a home, but that doesn’t really help the people that are really struggling, the people that are renting,” said Athena Katsarus, who is involved with affiliate group Make the Road Nevada.

“We lost our savings. We lost everything we put away because of the pandemic and the economic situation, and a lot of us are still trying to rebuild that,” Katsarus said. “It’s been really hard for people to bounce back, and some just can’t.”