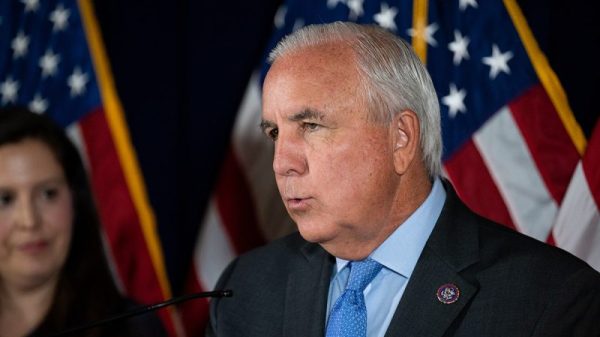

Sen. Josh Hawley, R-Mo., wants President Biden to increase tariffs on any imported energy components from China, a week after he introduced another bill that would hike tariffs on Chinese electric vehicle imports.

‘President Biden’s climate agenda undermines U.S. energy independence and will make us more reliant on China,’ Hawley told Fox News Digital in a statement. ‘We can’t afford energy policies that enrich our greatest adversary at the expense of American workers here at home. It’s time to declare our energy independence from China—and we can start by raising tariffs on China’s green energy sector.’

Tariffs are taxes or duties imposed by a government on imported or exported goods.

Hawley will introduce a new bill on Tuesday called the Declaring Our Energy Independence from China Act. It would require the president to apply additional tariffs on all battery components, solar energy components and wind energy components imported from China at a 25% rate.

The president could increase the rate by 5% annually for the next five years, peaking at 50%, according to the bill.

Since former President Trump’s term, the average U.S. tariffs on Chinese imports remain at approximately 19.3%, according to an estimate from the nonprofit research group Peterson Institute for International Economics.

The bill would also require a report on subsidies China provided to its battery, solar and wind energy sectors over the past 15 years, including direct fund transfers, tax breaks and preferential access to resources.

Last year, Biden halted tariffs on solar imports for two years. A bipartisan Congressional Review Act resolution was passed to end the pause, but the president vetoed it.

Biden also introduced mandates to transition American manufacturers and workers toward electric vehicles (EVs), targeting two-thirds of all U.S. automobiles to be EVs by 2032.

According to a U.S. Department of Defense report last summer, China controls most renewable energy equipment production and material supply chains.

Hawley is not the only one concerned about China dominating the U.S. energy industry. In January, a group of bipartisan senators sent a letter to Biden urging him to increase tariffs on Chinese imported solar panels.

‘By 2026, China will have enough capacity to meet annual global demand for the next ten years,’ Sens. Marco Rubio, R-Fla., Jon Osoff, D-Ga., Raphael Warnock, D-Ga., and Sherrod Brown, D-Ohio wrote. ‘This capacity is an existential threat to the U.S. solar industry and American energy security.’

Last week, Hawley proposed a bill to boost the current 2.5% tariff on vehicles to 100%, effectively increasing the overall tariff on all Chinese automobile imports from 27.5% to 125%.

Fox News Digital reached out to the White House for comment on Hawley’s bill.