Tech stocks surged this week as US and Canadian jobs data bolstered interest rate cut expectations.

Apple (NASDAQ:AAPL) hit a new all-time high on Wednesday (December 4), closing at nearly US$244, while Super Micro Computer (NASDAQ:SMCI) hit a weekly high of US$45.21 after a clean financial audit on Tuesday (December 3).

Super Micro Computer also got an extension from the Nasdaq for filing its annual report on Form 10-K. The news sent the company’s share price up 10 percent after hours on Friday (December 6).

Meanwhile, Bitcoin’s rally past US$100,000 is igniting conversations about corporate investment in the cryptocurrency.

In the political sphere, Donald Trump continued to stock his cabinet, choosing Gail Slater to lead the US Department of Justice’s antitrust division. Slater previously served as a tech policy advisor to the National Economic Council during Trump’s first term, after spending 10 years as an attorney for the Federal Trade Commission. In her new role, Slater will oversee antitrust cases against big tech companies, ensuring fair competition and addressing monopolistic practices.

“Big Tech has run wild for years, stifling competition in our most innovative sector and, as we all know, using its market power to crack down on the rights of so many Americans, as well as those of Little Tech!” Trump said in a statement.

1. Bitcoin smashes through US$100,000 barrier

On the heels of its biggest one month gain in history, Bitcoin has gone on to attain a new milestone, surpassing the US$100,000 landmark and notching a new all-time high of US$103,670 on Thursday (December 5).

The cryptocurrency hit record highs against both gold and silver as well. CryptoQuant data also shows a drop in Bitcoin exchange reserves as investors shifted to self-custody.

Spot Bitcoin exchange-traded funds (ETFs) recorded US$3.3 billion in net inflows over four days, with BlackRock’s IBIT crossing US$50 billion in assets for the first time on Tuesday.

Bitcoin’s market capitalization is now just short of US$2 trillion, less than 16 years after its inception.

The moment happened at 02:30 UTC, hours after Trump nominated Paul Atkins as chair of the US Securities and Exchange Commission (SEC). He will replace Gary Gensler after he steps down on January 20.

Atkins has also previously advised the Reserve Rights Foundation, the entity behind the RSR token, and is recognized for his balanced regulatory approach and deep understanding of securities law. A research report by CitiBank cites a combination of political and economic components as reasons for the rapid ascent.

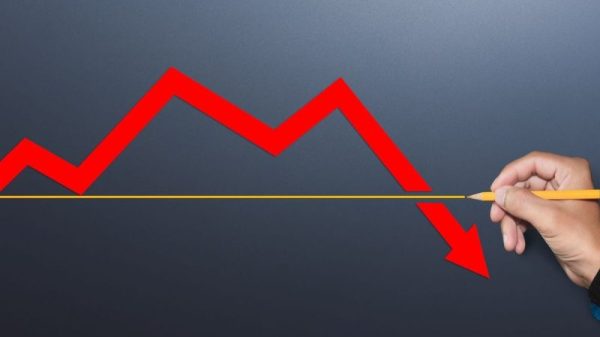

Bitcoin performance, November 30 to December 6, 2024.

Chart via CoinDesk.

Leading up to the announcement, reports emerged that Trump is considering crypto-friendly Perianne Boring and Caroline Pham to chair the Commodity Futures Trading Commission.

Last week, Fox Business reported that the Trump administration was planning to extend crypto jurisdiction to the US indicating that digital assets will be regulated as commodities.

Some analysts also partly attributed the surge to comments from Federal Reserve Chair Jerome Powell. He said on Wednesday that the cryptocurrency is more like gold than the US dollar.

Signs of a pullback also emerged for Bitcoin soon after its rise, and it plunged to below US$92,000 on Thursday afternoon with no obvious explanation. Ether, Solana, DOGE and XRP also saw losses.

Bitcoin’s recovered almost immediately, and it broached US$102,000 on Friday afternoon following jobs data that points to a higher likelihood of an interest rate cut after the next Fed meeting. However, crypto analysts like CoinDesk’s Omar Godbole have cautioned against impulsive decisions based solely on short-term price movements. Highly volatile price movements have brought the crypto Fear & Greed Index down to 72 from a high of 84 on Thursday.

Adding to market confusion, Fox Business’ Eleanor Terrett reported that the SEC will not approve any new crypto ETFs under the Biden administration, effectively rejecting two spot Solana ETF hopefuls. Meanwhile, Trump announced the appointment of David Sacks to the new role of White House AI and Crypto Czar via Truth Social post as prominent bankers dismissed Trump’s plan to establish a Bitcoin reserve as a “bad deal” and “crazy.’

2. Bitcoin rush spurs altcoin interest

While Bitcoin grabbed the headlines, altcoins have also experienced a rush of interest. Ethereum showed a particularly strong performance this week, with reports highlighting increased activity and investor confidence.

Its value surpassed US$4,000 just after the markets opened on Friday morning and reached an intraday high of US$4,089 in the final 30 minutes of trading. Research from Steno and Bernstein indicates a rise in transactional revenue on the Ethereum blockchain, driven by a surge in Ether activity and growing inflows to spot Ether ETFs.

Experts suggest this points to a potential end to Ether’s period of underperformance, particularly with the expectation of regulatory changes under the new administration that could further incentivize staking.

The Bernstein report notes that Ether’s supply has remained steady at 120 million tokens since its transition to a proof-of-stake consensus mechanism. Notably, around 40 percent of Ether’s supply is either staked or locked in DeFi protocols, and almost 60 percent hasn’t been traded in the last 12 months, indicating ‘HODLing’ behavior among investors and contributing to a degree of scarcity, further bolstering Ethereum’s long-term value proposition.

Ether price, November 30 to December 6, 2024.

Chart via CoinDesk

CoinDesk has also highlighted a pattern in Ether’s price chart that mirrors a pattern observed before Bitcoin’s significant rally last month. XRP’s price also saw a temporary increase driven by memecoin activity and trading on decentralized exchanges. Speculation about the SEC dropping its lawsuit against Ripple Labs and the potential approval of Ripple’s stablecoin, RLUSD, helped extend the rally on Tuesday.

3. MicroStrategy urges corporate investment in Bitcoin

MicroStrategy (NASDAQ:MSTR) shares received a nearly 12 percent boost mid-week, and the company’s Bitcoin holdings appear to be contributing to its positive momentum. The company is up 0.27 percent for the week.

The analytics company has been accumulating Bitcoin, scooping up US$1.5 billion worth of the currency between November 25 and December 2. Its most recent purchase brings the company’s total holdings to 402,100 coins.

CEO Michael Saylor has been a vocal advocate for Bitcoin since at least 2020, when the company made its first purchase. This week, Saylor said he gave a short presentation to Microsoft’s (NASDAQ:MSFT) board, suggesting the company add Bitcoin to its portfolio instead of conducting stock buybacks or issuing dividends.

Saylor was speaking on behalf of the Free Enterprise Project, the shareholder activism arm of the National Center for Public Policy Research (NCPPR). The NCPPR argues that Microsoft is risking shareholder value in the face of sticky inflation by “ignoring” Bitcoin’s potential as a strategic investment.

“Bitcoin is an excellent, if not the best, hedge against inflation,” the NCPPR claims in a statement, suggesting that mega-cap companies evaluate the benefits of allotting 1 percent of their total assets to the cryptocurrency.

Microsoft has urged its board members to vote against the proposal, dubbed Proposal 5 in a proxy statement released ahead of the board’s upcoming meeting on December 10. It remains to be seen how the board will vote, but MicroStrategy’s recent success and Saylor’s ongoing advocacy for Bitcoin could signal a shift in how major corporations view the cryptocurrency. While Microsoft’s stance is currently cautious, the pressure from the NCPPR and the example set by MicroStrategy may encourage other companies to reconsider their position on Bitcoin as a potential investment.

4. Intel CEO Geslinger forced to retire

Intel (NASDAQ:INTC) CEO Pat Geslinger announced his retirement on Monday (December 2) morning, providing a brief boost to the company’s share price at the opening bell.

Reports indicate that the company’s board gave him an ultimatum: retire or be removed. The decision perhaps comes as no surprise; Intel’s share price has plummeted over 50 percent year-to-date, and the firm is lagging behind its peers in terms of advanced chip manufacturing technology and market share in key areas like artificial intelligence (AI) and data centers, despite being the largest recipient of funds allocated to the Chips and Science Act.

The initial optimism surrounding Gelsinger’s departure was short-lived, and the company’s share price was down over 15 percent for the week at Friday’s closing bell. Intel’s CFO David Zinsner and executive vice president Michelle Johnston Holthaus are serving as interim co-CEOs while the board searches for Gelsinger’s replacement.

5. GenAI central to Amazon’s re:Invent conference

The Amazon re:Invent 2024 conference, held this week in Las Vegas, Nevada, showcased Amazon’s (NASDAQ:AMZN) cloud innovations with a major focus on generative AI.

The company revealed added tools for building and deploying AI to Amazon Bedrock, including a marketplace for foundation models like those in the new Amazon Nova family, and features to improve accuracy and safety. Amazon also highlighted advancements to SageMaker, simplifying data management and analysis.

Further announcements included new energy-efficient data center technologies, such as enhanced cooling systems, the use of renewable diesel for backup power and a redesigned server rack layout to minimize unused power. Some of these components are already in use, while others will be implemented in future data centers. Additionally, AWS is adopting liquid cooling systems to effectively manage the heat generated by high-performance chips, particularly those from Nvidia, which cannot be adequately cooled using traditional fan-based methods.

The company also disclosed new and expanded partnership agreements, including a major deal with Oracle that will see the company run its databases on AWS, integrations with companies SAP and Adobe to improve their services using AWS’s cloud, a deeper collaboration with GitLab to infuse AI into the software development process and a partnership to launch digital twin-powered integrated airport operations command center on AWS.

Finally, AWS also introduced Project Rainier, a massive supercomputer powered by hundreds of thousands of its custom-designed Trainium2 chips. Designed to train advanced AI models, the “ultracluster” is purpose-built for training the next generation of AI models in collaboration with Anthropic. AWS also announced the general availability of Trainium2, making this powerful technology accessible to all its customers, a move that has the potential to significantly shift the landscape of AI chip development, currently dominated by NVIDIA (NASDAQ:NVDA).

Seeking Alpha also reported this week that Amazon is in talks with news publishers about licensing their content to develop a smarter version of Alexa that leverages generative AI to deliver customized responses to real-time news queries from users. The launch of this enhanced Alexa is planned for next year.

Amazon stock closed up over 8 percent for the week.

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.