US Steel and Nippon, whose $14.3 billion merger was blocked by President Joe Biden last week, filed a lawsuit against the US government Monday, claiming Biden’s executive order to bar the companies from combining was signed for “purely political reasons.”

“Today’s legal actions demonstrate Nippon Steel’s and US Steel’s continued commitment to completing the transaction — despite political interference,” the companies said in a statement.

The suit is no surprise. The day Biden issued an order blocking the deal, the companies called the action “a clear violation of due process” and said they had “no choice but to take all appropriate action to protect our legal rights.”

Biden had spoken for months about his opposition to the deal. The companies said that Biden had “ignored the rule of law to gain favor with … (the United Steelworkers union) and support his political agenda.”

In addition to the suit seeking to throw out Biden’s order, the companies filed a separate suit against Lourenco Goncalves, CEO of rival steelmaker Cleveland-Cliffs and Dave McCall, president of the United Steelworkers union, for their actions to try to block the deal, which the suit charges are “anticompetitive and racketeering activities illegally designed to prevent any party other than Cliffs from acquiring US Steel as part of an illegal campaign to monopolize critical domestic steel markets.”

In addition to seeking to block Cliffs and the USW from acting together, that separate lawsuit seeks “substantial monetary damages for their conduct.”

Neither the White House, Cleveland-Cliffs, nor the USW had an immediate response to the lawsuits.

In August 2023, US Steel announced it had received multiple offers to buy the company and that it would weigh the offers. It confirmed that one of the offers was from Cleveland-Cliffs, which had already passed US Steel to become the second-largest American steelmaker behind mini-mill operator Nucor, but that those talks had broken down.

The Cleveland-Cliffs offer at that time was worth about $7.3 billion in cash and stock, or about half what Nippon would eventually offer when it reached the agreement to buy US Steel in December 2024. But as a unionized steelmaker, Cleveland-Cliffs had the support of the USW in its bid.

Last summer, US Steel announced that without the investment in its older, union-represented mills promised by Nippon Steel as part of the deal, it might be forced to close the mills. In response, Cleveland-Cliffs said it would be willing to buy those mills.

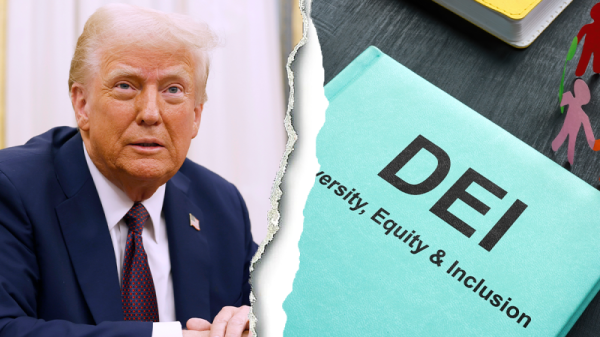

The opposition to Nippon Steel buying US Steel has been bipartisan, with Vice President-elect JD Vance an early opponent of the deal. President-elect Donald Trump has also vowed to block the deal if it was still alive once he takes office later this month.

This is a developing story and will be updated.